Church Management Software for Small and Large Churches

Just keep in mind, pricing can easily jump depending on your use case. Aplos also integrates staff payroll, so there’s no need to maintain a separate accounting system for regular (and irregular) paydays. Easily manage events with unlimited custom registration forms and automatic attendance tracking for registrants. You can sell individual and group tickets for retreats or fundraisers, and people can also RSVP for free events, like potlucks. For organizations tracking budgets and financials for grants, programs, departments, or multiple locations. Easily track pledges and generate pledge statements to remind your people about upcoming payments.

The Best Business Accounting Software Services of 2024

ACS’s Church Accounting will help you streamline your cash flow and spending, monitor asset values, document insurance claims, and much more while effectively managing your outgoing billings and incoming payments. Handle the special needs of churches and pastors and apply housing allowances and insurance, so you can accommodate multiple cost centers, customize with the additions and deductions to pay. Coordinate bill payments and issue 1099s, while checking writing, applying e-filing for federal and state tax laws, deploying batch invoicing, and more. ChurchTrac is simple yet scalable, and it allows you to make deposits simple and easy to track, generate income statements, balance sheets, fund statements while streamlining the ideal budget for any occasion. Built to help churches of all sizes, FlockBase will ensure your church staff and volunteers learn the software with minimal training quickly and enable you to optimize your church’s finances.

What does an online accounting service do?

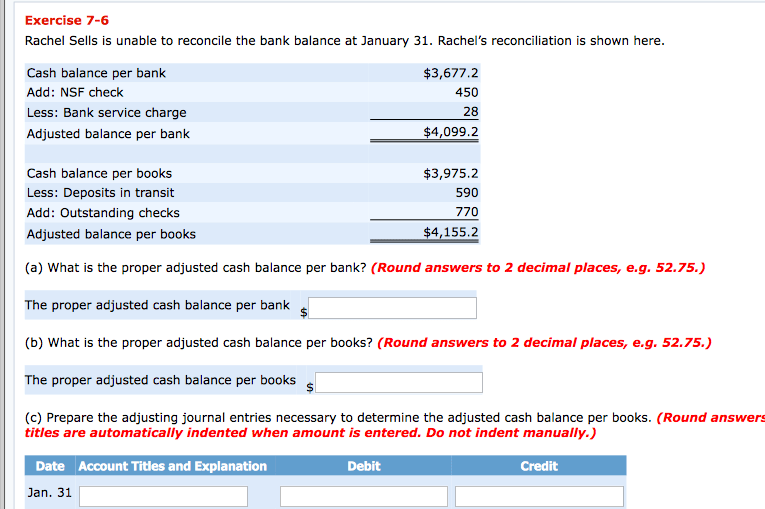

It can track project expenses and perform in-depth financial planning for projects. Features include time tracking and reports, budget building and estimates, customized quotes (so donors know the need), cost linking to jobs and projects, and reports that show how every donor dollar is spent. The best church accounting software offers full accounting functionality at affordable nonprofit prices. In the end, we selected the 10 best church accounting software of 2024. Online accounting services can perform a wide range of tasks for busy business owners. Some focus on bookkeeping duties, such as entering and categorizing transactions, reconciling accounts, and generating financial statements and reports that you can take to your certified public accountant (CPA) at tax time.

Which version of QuickBooks is best for churches?

Finally, we considered a software’s ability to integrate with church management software. CDM+ is a web-based church management system (CHMS) that offers contribution management, attendance tracking, event scheduling, planning center, and check-in functionality. Using this software, church administrators can record member information such as names and addresses in a central location. It’s sort of like the best church management and best church accounting software software all rolled into one.

Do you prefer the one-time purchase of desktop software or cloud-based software for a monthly fee?

In addition to that, the software is also well known for its budgeting capabilities, that allow organizations to set and track budgets for individual funds or grants, and compare them to actual financial performance. When you log in to your account, you’ll be greeted by a dashboard that shows you an overview of your account activity and key metrics, such as cash flow, profit and loss, account balances, expenses, accounts payable and receivable, and sales. Offer options for your people to give through new ways, like your website and text messaging, to increase gifts and donations. Easily track donations, create giving statements, and apply contributions to their intended funds—all in one place. As a church owner, you know that providing the best environment to your congregation not only includes offering your support but making sure your finances are “in the black”. Afterall, you want to offer new events, keep up with repairs and make sure the lights stay on.

In its most affordable plan, you can create church member and staff profiles and offer a selection of donation methods, devices and even schedules. You can also track donations on giving dashboards, enter and manage donor pledges and manage restricted funds. https://www.intuit-payroll.org/ Its Connect plan further allows churches to engage members in personalized ways. Finally, its top-tier Multiply plan has tools to manage multi-campus church membership and funding. You can add payroll processing for $40 per month, plus $6 per employee.

The pre-built planning templates are designed to engage church leaders in the planning process, while accurate, real-time data assists with analyzing budgets. Based on my technical consulting for a metropolitan church, I’ve shortlisted and reviewed the best church bookkeeping software to help you manage your church’s affairs responsibly and even increase donations. Software exists to help with almost every aspect of running a business, so it’s no surprise that there are an equal amount of tools available for nonprofits, and thus, faith-based organizations such as churches. We use this historical data of donations, pledges, programs, and funds to help predict your future income and cash flow. In a quick glance, you can see how much cash you have on hand at any moment and how much you owe in bills. Selecting the right plan depends on your church’s size and specific financial management needs.

Maintain your tax-free eligibility with detailed reporting and expense tracking you can access at any time. By leveraging these benefits, lead pastors can not only enhance the accuracy and efficiency of their church’s financial management but also build trust with their congregations through greater transparency. Another strength of Botkeeper is its ability to provide real-time data insights. Botkeeper the income statement is able to analyze financial data in real-time, providing churches with a clear picture of their financial health and performance. This allows them to identify trends, identify areas for improvement, and make more informed decisions about their financial strategies. Additionally, PowerChurch Plus offers tools for managing member communications, including email, text messaging, and social media.

You can also save time by using built-in templates, as well as granting user-level permissions based on individual need. Bitrix24 provides social tools for engaging your congregation, like social network, user groups, polling, media gallery, shared calendars, video conferencing and more. It can also help you manage your church board by organizing your structure, and keeping a church directory. With QuickBooks Online Plus and Advanced, W-2s are automatically generated at the end of the year, and if you hire contractors like musicians or caterers, their payments are tracked throughout the year, so you can issue and file a 1099. Plus, because it’s online, you and your team can run payroll on the go.

- A similar report that dove into the buying trends of companies purchasing fund accounting software (which, as mentioned before, is a software primarily used by nonprofits) found that they too had the same primary motivation.

- Finally, look for software that offers greater advantages by connecting to other business applications you already use, such as your POS system, CRM system or the best email marketing software.

- Slice and dice your financial reporting to see the exact data you need across your church.

- Connect your bank to QuickBooks to auto-sync transaction and see all your finances in one place.

- If your church needs an affordable payroll add-on, IconCMO is the best choice.

- Support from our award-winning team is included with every package, and we encourage you to reach out when you need help.

After careful consideration, I’ve determined that these are the most important criteria when selecting the best church bookkeeping software. You can automate tasks, improve member data and coordinate complex events. It’s easy to schedule the use of facilities or resources, while also gaining deep insights using the reporting tools. Here’s a brief description of each church bookkeeping app, showcasing each tool’s best use case, some noteworthy features, and screenshots to give a snapshot of the user interface. While a solution that was developed specifically for the church is recommended, you may find success using solutions found in these related software categories. Whether you’re presenting in a monthly meeting to congregants or delivering financial presentations to the board or committee, it’s easy to create the right report for each audience.

You must also pay $25 per month for every two users added above the included two-user limit. This feature connects the software to your business bank and credit card accounts to provide a daily update of your transactions. This saves time, as you will not have to upload transactions manually. It also gives you a daily, rather than monthly, overview of your accounts. A real-time bank-feed feature can assist with reconciliation, which allows you to make it a small daily task rather than a monthly ordeal.

FellowshipOne assists churches and other religious organizations to structure and manage daily operations. Based in the cloud, the software simplifies administrative tasks, outreach, events, and communications. An alternative scenario is a church that has the means (usually the funding) and the motivation to pursue a new software solution. However, they need to ensure that they have the resources available to train their staff.

The software should allow you to invoice customers for tracked time and bill them for project expenses. If you’re a consultant or your business bills clients by the hour, you need accounting software that allows you to track and bill your time or that integrates with the time-tracking program https://www.accountingcoaching.online/depreciation-definition/ you already use. This is an important feature in the best accounting software for freelancers. When you’re choosing accounting and billing software for your business, we strongly encourage you to take advantage of free trials to test the solutions and see which one offers the tools you need.